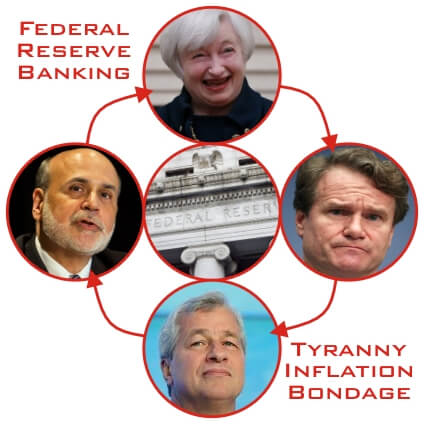

Private Family Banking vs Federal Reserve Banking

Speaking to families all over the country about private family banking, I’m always shocked to learn how little they understand about the eroding effects of Federal Reserve banking, and it’s impact on their personal economy.

Everyone is always concerned about the interest rate they are paying, yet they continue to pay the banks interest and fees for access to capital. And, rarely do they question the fees and the costs associated with financing.

Many will research the topic of the Federal Reserve and discover that the system is corrupt, but they feel trapped and frustrated. Fortunately, once people understand how they can take control of the banking function in their lives, their mood changes and they start to get excited.

If there were only one thing to learn about banking it would be easy, but it can get complicated, and the wealthy bankers like it when we’re confused.

So, if you could simplify everything, which is better? Federal Reserve Banking or Private Family Banking? First you have to understand these major differences.

Federal Reserve Banking

- Federal Reserve System

- Fractional Reserves

- Financial Tyranny

- Serfdom

Private Family Banking

- Private Family System

- Capital Reserves

- Financial Freedom

- Truth

Imagination

Imagine never having to depend on banks for money. Meaning that you have freedom from bank qualifying and government red tape.

What if you had access to capital at any time for opportunities? Have you ever considered starting a business? Investing in real estate?

What if you could give more to your church or causes you care about?

What’s the difference in banking?

- Control

- Reserves

- Liberty

The banking function is the key component when discussing control. Most people think because they maintain the account they have control. However because of increasing regulation like the Dodd-Frank Act, disquised as consumer protection, the financial institutions control the capital and the bankng function.

During a Brookings webinar, Former Federal Reserve Chair Janet Yellen, said “I personally think we need a new Dodd-Frank.” and “We need to change the structure of FSOC and beef up its powers…”

Controlling it is the most important thing you can do over your lifetime.

~Nelson Nash (Bestselling Author of Becoming Your Own Banker)

What are reserves?

Federal Reserve banks work on the fractional reserve system. Banks are required to only hold 10% of their deposits on reserve, meaning they can gamble with the other 90%. And, if they lose… Well that’s what bailouts are for right?

Ironically, banks store their 10% (Tier 1 Capital) in specific life insurance contracts called BOLI or Bank Owned Life Insurance.

On the other hand, Family Bankers can also own and utilize specific types of life insurance contracts as a place to store their capital reserves. This means they can control the contract and can set the terms for financing.

At the end of the day, if all of your money is in the the federal system, you will pay more, have less available, and keep less for your family.

To learn more about private family banking, schedule an introductory meeting.