Bank Failure

Bank failure generally occurs when a bank can no longer meet its obligations to depositors and creditors. But the question is, are banks too big to fail?

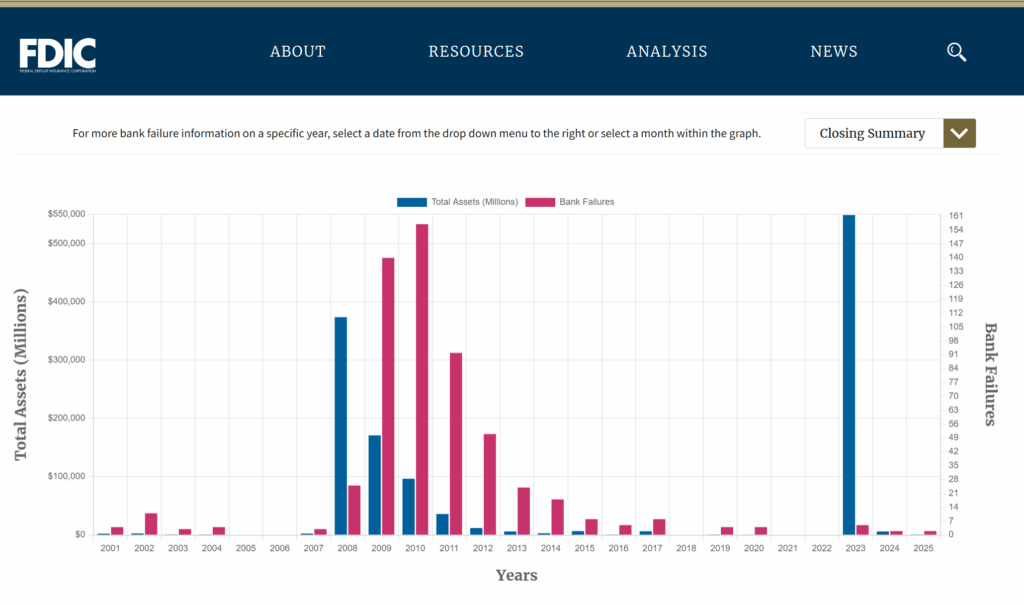

This chart from the FDIC website shows the bank failures over the last 25 years. In summary “there were 570 bank failures from 2001 through 2025.“

Now on the surface they may seem low now, but when you consider history and the spikes, it can be concerning.

Think Like A Family Banker

It’s our business to teach others how to think like bankers, but avoid the risks that banks sometimes assume. Things like fractional reserve lending and derivatives trading. When it comes to underwriting, collateral and financing, we can follow the same rules that bankers do in our own financial lives.

However, the big banks have a “slight” advantage when it comes to following rules and taking risks, they can pass them on to the taxpayers. We have to assume responsibility when we become the banker, and this accountability reduces our risks.

Bank Failure and History

Looking back on American history, the longest time we have gone without a single bank failure, was from 2004 to 2007. For a consecutive 32 months, not a single one of the over 7,000 banks in America failed.

In the past 85 years there have only been 6 times over any twelve consecutive month period without a bank failure. The stretch leading up the 2008-2009 crisis was more than twice as long as any other stretch since the end of WWII.

When there is not a single bank failure over an extended period of time, it should be a strong warning sign of major problems. No marketplace that institutes competitiveness can avoid some failure.

Bank Competition

Banks are supposed to be in the business of competing with one another to give consumers the best value and most options with their money. In an environment such as this, some will fail, however that doesn’t seem to be the case.

A bank’s failure or success should be based on their business practices for allocating risk, making prudent loans and providing value to their customers. But, that’s not where we are. Instead, financial regulators charged with protecting the safety and soundness of the banking system that is veering toward collapse are applauding them.

Banks again are experimenting with derivatives and other elaborate means to generate profits, while taxpayers are on the hook. The derivatives market has been estimated to be more than a QUADRILLION dollars.

Bank Regulation

In fact, according to the Office of the Comptroller of the Currency’s (OCC) quarterly report on bank trading and derivatives, “derivative contracts remained concentrated in interest rate products, which represented 76.0 percent of total derivative notional amounts”.

https://www.occ.gov/topics/capital-markets/financial-markets/derivatives/dq218.pdf

FDIC Protection

And the FDIC, which is supposed to protect depositors with insurance, is in reality funded by the people.

The FDIC loves to tout, “No depositor has lost a single cent of insured funds as a result of a failure.” Yet, the FDIC is backed by the full faith and credit of the United States government…

“My friends, there is good news and bad news. The good news is that the full faith and credit of the FDIC and the U.S. Government stand behind your money in your bank. The bad news for you, my fellow taxpayers, is you stand behind the U.S. Government.” –L. William Seidman, former head of the Federal Deposit Insurance Corp. (FDIC)

The Costs of Doing Business

Much like other businesses include the costs of doing business into the sale price of their products, banks do also. Banks incorporate these special fees and insurance premiums into the interest rates they offer on their deposit accounts.

Bank Rules

Unlike most businesses, banks are given special charters by the government, as opposed to licenses. For the most part, you have to pay to play.

Additional approvals are required from the Federal Reserve if at formation, a company would control the new bank and/or a state-chartered bank would become a member of the Federal Reserve.

Are banks really too big to fail?

Many feel that another financial crisis is inevitable. Would you be willing to support another taxpayer funded bailout of the banks?

“It is well enough that people of the nation do not understand our banking and monetary system, for if they did, I believe there would a revolution before tomorrow morning.” ~Henry Ford

Take Control

It really boils down to this, are you comfortable having the banks and the government in control of your money? If you’re not, and you want to discover a better way, then request a meeting.

Until next time,

Happy Banking!